Higher Highs And Lower Lows

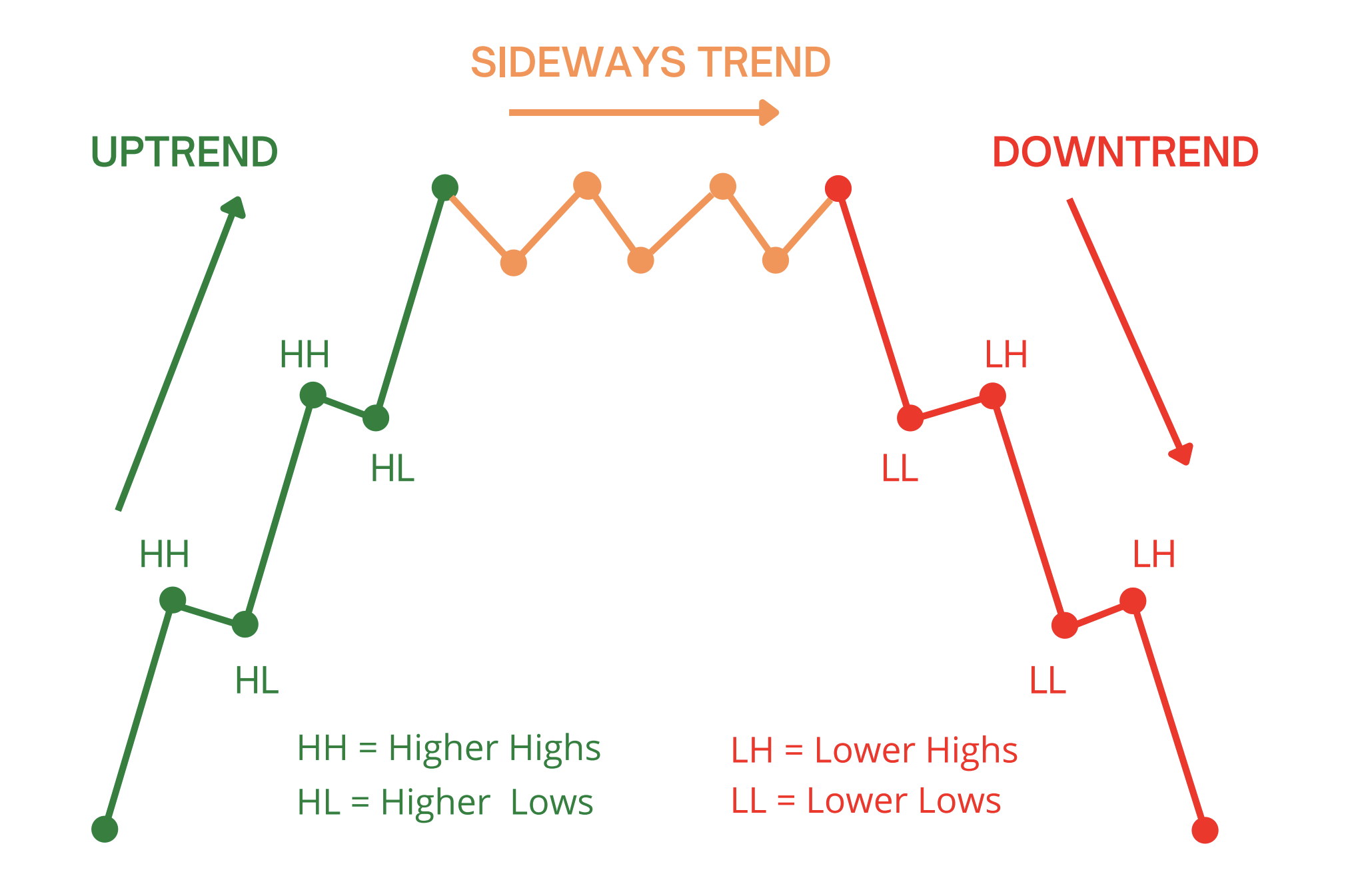

A Higher High/Lower Low is a popular trading strategy based on identifying trends in a stock's price movements. It involves looking for higher highs and lower lows to determine the overall direction of the stock. Earn up to $1000 on Binomo! Use a. BLOG80.

what is higher high & higher low and lower low & lower high in the stock market? Complete guide

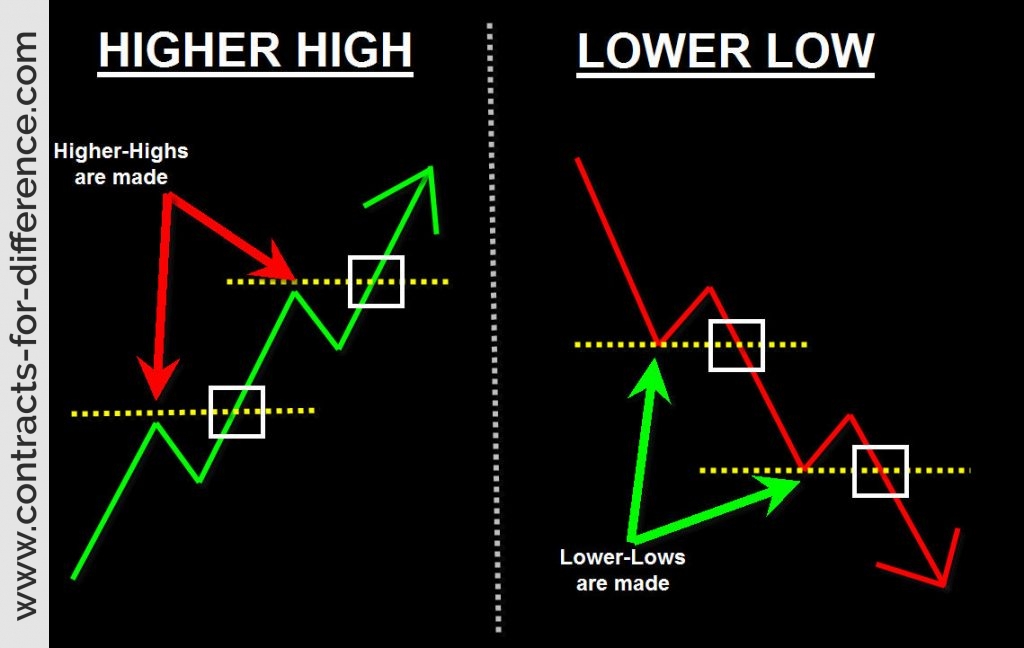

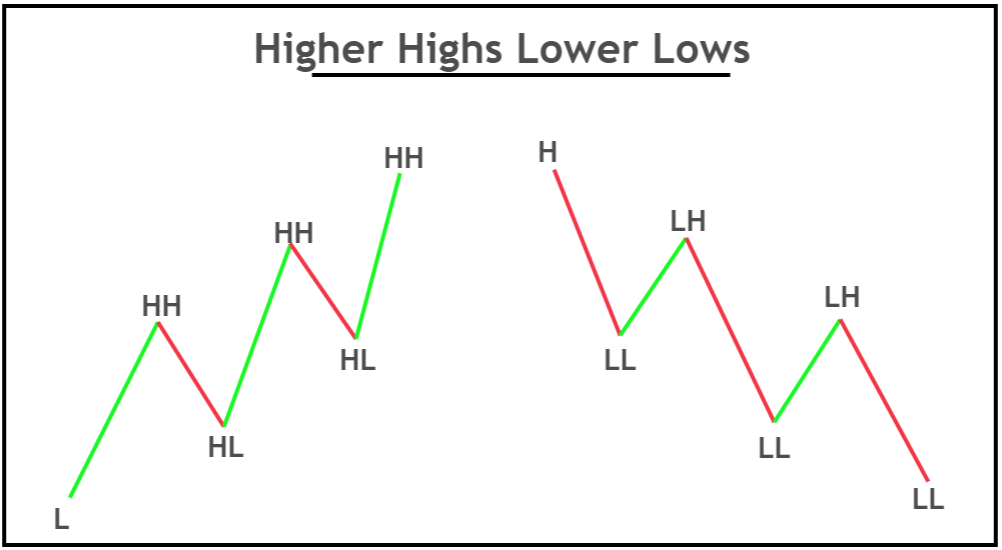

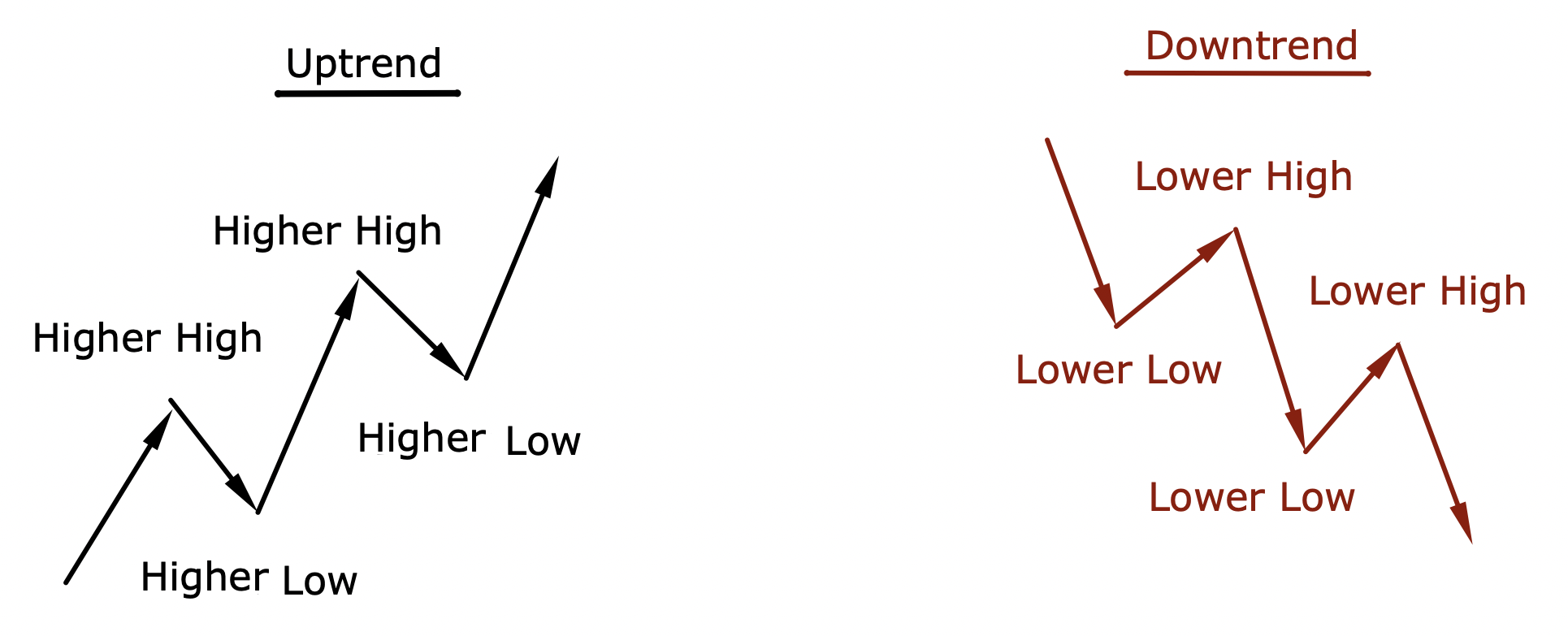

A "lower high" occurs when the price of a currency pair reaches a high that is lower than the previous high, followed by a downward price movement. A "lower low" occurs when the price of a currency pair reaches a low that is lower than the previous low, followed by a downward price movement.

High Low Vector Art, Icons, and Graphics for Free Download

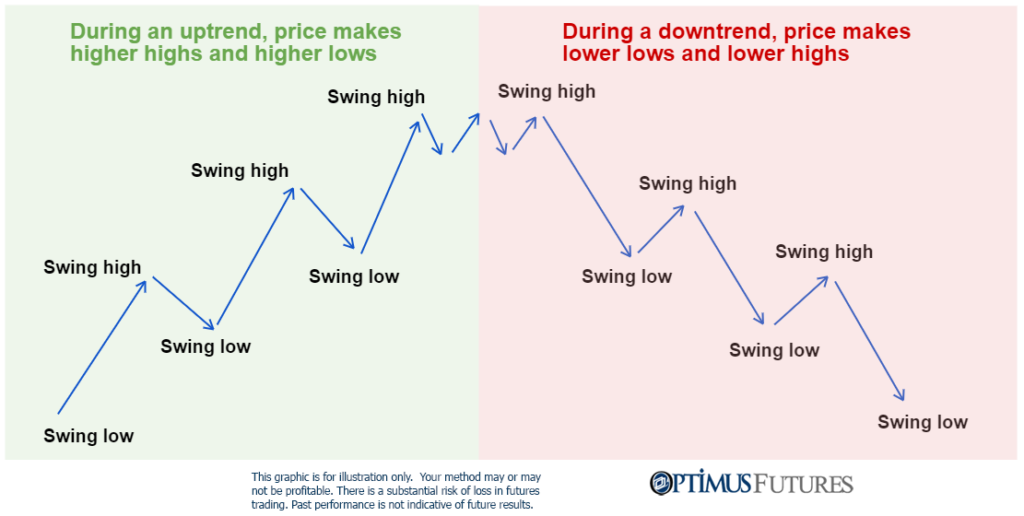

highs & higher lows. 2 Likes Jocelyn May 24, 2017, 12:48pm #4 sixdegree: I've tried to look for the meaning of "lower high" and " Higher low" I couldn't find it anywhere. can someone explain for this newbie please? if you have a picture it will be great The example below clearly shows price action trending to the upside.

Day Trading in the UK How to Get Started My Trading Skills

Lower highs and lower lows mean the low and high of the recent candlestick is lower than the lower and high of the previous candlestick. The formation of consecutive lower lows and lower highs in the price of a currency during a specific timeframe is referred a bearish trend in forex trading.

Higher High Lower Low Trading Strategy

The HHLLS (Higher High Lower Low Stochastic) study is a momentum-based technical indicator developed by Vitali Apirine. It consists of two stochastic lines, the calculation of which is inspired by StochasticFull and Williams%R. The main purpose of HHLLS is to recognize trend behavior: emergence, corrections, and reversals.

Ultimate guide to Higher High Lower Low Trading Strategy Learn Forex Trading and foreign

Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. There are two types of divergences: Regular divergence Hidden divergence Each type of divergence will contain either a bullish bias or a bearish bias.

Higherhighs And Higherlows The Complete Guide (UPDATED)

Rising Pivot levels overtime can help you find a significant higher low to enter a buy trade or lower high to enter a sell trade on. Learn Forex: Pivots Clearly Paint Dynamic Levels of Rising.

Ultimate guide to Higher High Lower Low Trading Strategy Learn Forex Trading and foreign

July 1, 2022 by David Roads There are many trading strategies, but the higher high lower low method is the most effective one. You can trade using this strategy in any type of financial market like forex, stock, crypto. What is Higher High and Lower Low

What Are Market Trends and How to Take Advantage of Them Unger Academy

A bullish divergence is signaled when the RSI indicator has an oversold reading then a higher low that correlates to lower lows in the price action. This can show increasing bullish momentum, a break out back above an oversold reading is a common buy parameter used to signal a new long position.

Using a trend correctly when trading

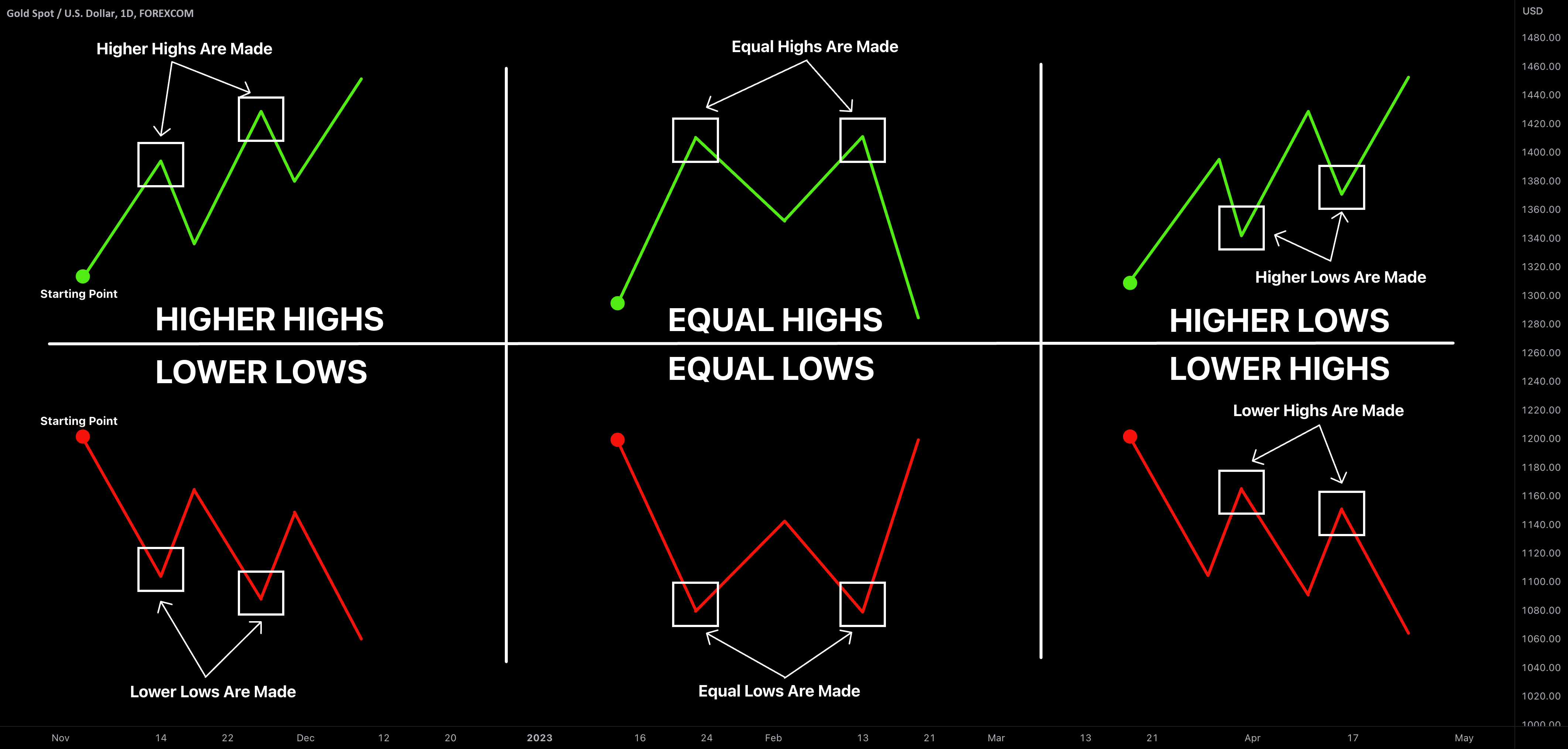

When the price breaks out of a consolidation or trading range, forming a new higher high or lower low, it often signals the beginning of a new trend. Traders can take advantage of these breakouts by entering trades in the direction of the emerging trend. Conversely, when highs and lows fail to form, it may indicate a potential trend reversal.

TradingView Higher High Lower Low Indicator Best Indicators For Options Trading Live Trading

In this Trading Basics video, we will explain the concept of lower lows and higher highs in technical analysis, which is a common technique used by many trad.

Higher Highs And Lower Lows 📈 📉 Your Guide To Understanding Uptrends And Downtrends Margex

A "higher low" occurs when the price of a currency pair reaches a new low that is higher than the previous low, without being preceded by a lower low. These price movements can indicate a bullish trend and can be used as a trading signal. How Higher Highs & Higher Lows Create Bullish Trends

Cutting through the noise analyzing price action correctly

The lower highs and lower lows pattern - strategy 1 The first column shows the holding period in days. The first row shows that if we exit on the next day's close the average is 0.09%. If we exit after two weeks (ten trading days), the average increases to 0.47%.

How to Identify Higher Highs & Higher lows (BUY LOW Trading strategy) YouTube

Countertrend Trading Strategies: Using Higher High And Lower Low Failures To Profit. Trend analysis can also tell traders when it is time to switch to a countertrend strategy. This type of trading strategy trades counter to the trend. A higher high failure is a signal that an uptrend may be at risk of reversing and prices will soon retrace.

Higherhighs And Higherlows The Complete Guide (UPDATED)

Lower High Lower Low. Lower High Lower Low is a technical pattern widely used in forex trading to identify potential trend reversals and forecast future price movements. This pattern occurs when the price of a currency pair forms a series of lower highs and lower lows, indicating a shift in market sentiment from bullish to bearish.

What is Higher High, Higher Low, Lower Low, Lower High for by VasilyTrader

Register in 2 Steps When identifying downwards asset value trends they use a very similar technique: Lower low: If the price of a security closes at a lower price than it did at the close of the previous day, which was also a low, then it is referred to as a lower low.